Why Hire a Realtor When Buying a New Construction Home?

March 10, 2024

Las Vegas Electricity Bill Hacks: Save Big with These Top 10 Tips

March 17, 2024Las Vegas Vegas Housing Market Update – March 2024

Las Vegas Housing Market Update – March 2024

Hey everyone, welcome back our March 2024 issue of our monthly market update for Southern Nevada!

Today, Rob and I are diving into the February 2024 Las Vegas Housing Market numbers, and let me tell you, it’s absolutely on fire! We’ve seen an impressive increase in sales, median price, and listings, signaling a very dynamic market. However, there’s a twist – while these numbers are soaring, our months of supply and inventory have taken a dip. With this limited inventory, we’re anticipating that median prices will continue to climb unless more sellers decide to join the game.

But that’s not all we’ve got lined up for you today. We’re also going to be looking at Builder Incentives for new construction homes for March 2024. With the market as hot as it is, understanding what incentives are out there could be a game-changer for many of you considering buying a new home.

And for a bit of fun, we’ll be revealing who won last month’s bets between Rob and me. Trust me, you don’t want to miss the outcome of this friendly rivalry!

So, buckle up for an exciting show as we break down the numbers, explore potential opportunities, and share our insights on the ever-evolving Las Vegas housing market for March 2024. Stay tuned!

MARKET TRENDS

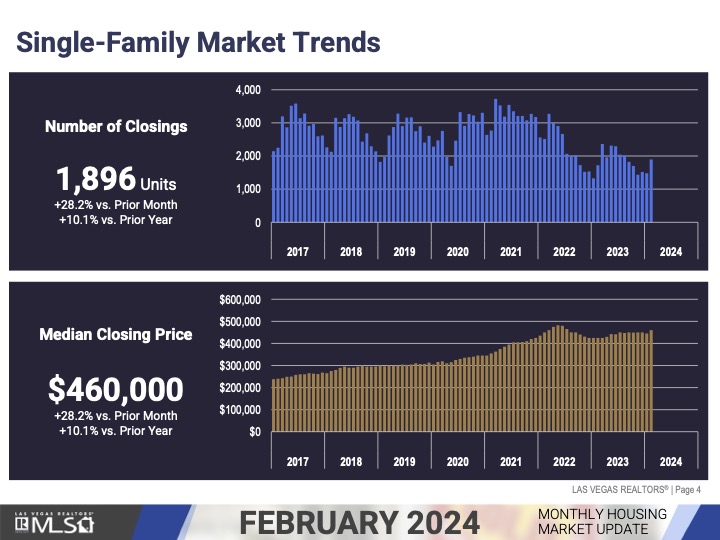

There were 1,896 single-family houses that sold in February, up 28.2% from January and up 10.1% from February 2023.

The median sales price of previously owned single-family homes, went from $445,000 to $460,000 in February, a $15,000 median price increase which is also up 28.2% from January and up 10.1% from February 2023.

So, from February 2023 to February 2024, we had a $35,005 median price increase in single-family homes.

In February 2024, the median price of previously owned single-family homes was at $460,000.

In February 2023, the median price of previously owned single-family homes was at $424,995.

In February 2022, the median price of previously owned single-family homes was at $450,000.

In February 2021, the median price of previously owned single-family homes was at $355,000.

The peak of the Market was in May 2022 at $480,000 at this rate, we will surpass the peak of the market this year, in my opinion. As of now, we are only $20,000 off from the peak.

The median sales price of condos and townhomes for February went from $275,000 to $283,000, which is up 2.9% from February and up 11% from the prior year.

So, from February 2023 to February 2024, we also had a $28,000 median price increase in condos/townhomes.

In February 2023, the median price of condos and townhomes was at $255,000.

In February 2022, the median price of condos and townhomes was at $260,000.

In February 2021, the median price of condos and townhomes was at $197,500.

LUXURY MARKET

There were 131 homes that sold in January for $1 million and over, compared to January’s 91 homes, 40 home increase.

The median sales price in the Luxury Market for February decreased to $1,400,000 and in January that number was $1,500,000. A $100,000 decrease in the median sales price.

MARKET TRENDS

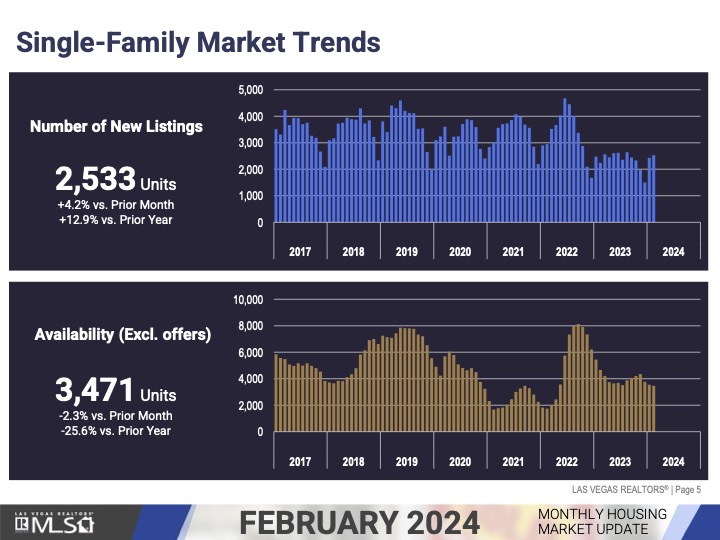

So, for February we had a total of 2,544 new listings, which is up 4.2% from January and up 12.9% from the prior year.

There were also a total number of 3,471 single-family houses listed without offers in February, which is down 2.3% from the previous month and down 35.6% from the prior year.

MARKET TRENDS

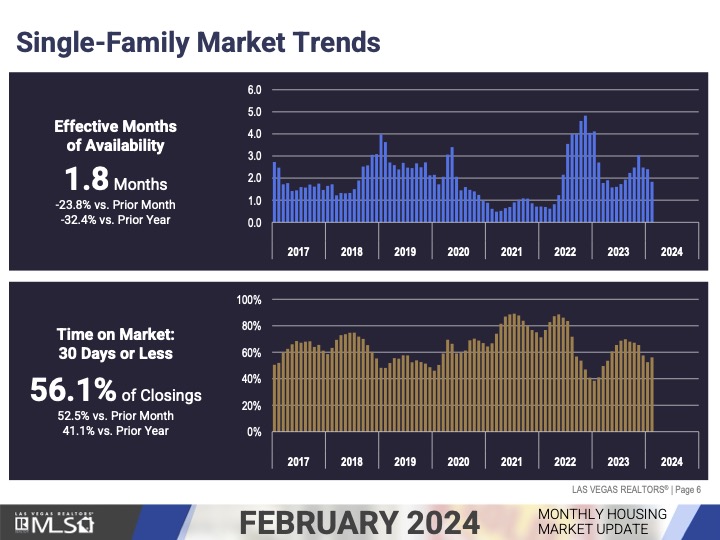

Which brings us to the housing supply in Southern Nevada, last month we are at 1.8 months of inventory on the market, which is down 23.8% from January and down 32.4% from the prior year.

February 2023 there were 2.7 months of inventory on the market.

41.1% of the closings for the month February was on the market 30 days or less, in January this number was at 38.5% and in February 2023, 76.8% of the homes were on the market 30 days or less.

INTEREST RATES

Rate Hikes in 2022 and 2023

The Fed raised interest rates 11 times between March 2022 and July 2023.

- Mortgage rates increased rapidly, touching 8.45% in October 2023.

- Home sales reached a 30-year-low, falling by 19% year over year.

- Housing affordability sank in response.

- Housing supply also shrunk considerably as people were unwilling to sell in an unfavorable market.

Housing Market Has Improved

There’s some improvement in the housing market. The mortgage rates have finally dropped to 6.88% on the 30-year-fixed. This is the first drop in a month and it has prompted a spike in mortgage application numbers as well.

More sellers are listing their homes recently. The increased inventory will also improve market conditions.

The Fed is still waiting for the inflation rate to be closer to 2% before they initiate rate cuts. But these cuts are coming sometime this year unless inflation ramps up once again.

NEW BUILDER INCENTIVES – March 2024

Take the next step in your home buying journey with a 30-year fixed rate loan on select homes when financing with Century Communities affiliate lender, Inspire Home Loans. Get 4.875% interest rate for FHA and VH loans or get 5.25% interest rate with a conventional loan.

Rates available as of 3/7/2024. FHA or VA loans rates are available only on the purchase of a Century Communities or Century Complete home that contracts and locks on or before 3/19/2024 and closes on or before 03/29/2024. Conventional loans rates are available only on the purchase of a Century Communities or Century Complete home that closes on or before 04/30/2024. Availability is limited and subject to change at any time without notice.

For a limited time opportunity, finance your new KB home through KBHS Home Loans and get a 5.875% 30-year fixed interest rate on a home that closes by 11/30/24.

Lennar Homes is having their Spring Savings Event on homes that can close quick with a 4.99% interest rate on a 30-year loan, plus $6000 towards closing costs that can close by the end of May!

Pulte is offering limited time special financing on a 30-year fixed rate at 5.25% interest rate on a Conventional Loan ONLY, with a minimum of 20% down for their quick move-in homes when you use their in-house lender. Offer available only on certain inventory homes that contract from 2/15/24 and close by 4/30/24.

Richmond American is offering special financing options— while funds last. Plus, an additional $5,000 in closing cost assistance is available with select homes that contract by 3/17/24. Must use their preferred lender, Home American Mortgage Corporation to take advantage of these special interest rates.

Fixed Rate Close by 4/30/24

5.25% 30-year FHA fixed rate w/ 3.5% down

5.25% 30-year VA fixed rate w/ $0 down

5.625% 30-year Conventional fixed rate w/ 10% down

Fixed Rate Close by 6/28/24

5.5% 30-year FHA fixed rate w/ 3.5% down

5.5% 30-year VA fixed rate w/ $0 down

5.99% 30-year Conventional fixed rate w/ 10% down

Taylor Morrison is offering a limited time fixed interest rate at 5.49% for a 30-year fixed mortgage on select quick move-in homes in the Las Vegas area.

Valid on new home contracts entered from now until 3/31/24 on all eligible Las Vegas area Quick Move-in Homes that close on or before 5/3/24 (“Promotion Period”).

Choose a beautiful new Toll Brothers quick move-in home now and qualify for a special 5.99% 30-year fixed interest rate offer through Toll Brothers Mortgage Company. This offer is subject to mortgage rate availability and is limited to select quick move-in homes eligible to close by April 30, 2024.

During Tri Pointe’s Unlock Opportunity event, turn your dream home into your new home—with limited-time savings you won’t want to miss.

VA 30-Year Fixed 2-1 Buydown with $0 Down Payment

During Tri Pointe’s limited-time event, take advantage of VA 30 year fixed 2-1 buydown financing on select move-in ready homes. Year 1 get 3.875% interest rate, Year 2 get 4.875% interest rate, and years 3-30 get 5.875% fixed 30-year interest rate. (Arrow Peak & Azure Park)

$25,000 in Design Studio Credit

During Tri Pointe Homes limited-time event, take advantage of up to $25,000 in Design Studio credit on select move-in ready homes. (Citrine)

To receive the incentive, you must enter into a purchase for an eligible homesite by 5/31/24 and close by 7/26/24. Incentive applied upon closing.

ROB & ANG BETS

MEDIAN SALES PRICE

Rob said $1000 decrease

Ang said $5,000 increase

Actual # $460,000

Ang won this one!

WITHOUT OFFERS

Rob said Flat

Ang said 3,400

Actual # 3,471

Ang won this one!

MONTHS OF SUPPLY

Rob said 2.5 months

Ang said 2.3 months

Actual # 1.8 months

Ang won this one!

LAS VEGAS REALTORS REPORT – March 2024

If you’re considering buying a home in the Las Vegas Valley, please don’t hesitate to reach out to me. I’ll get back to you personally and promptly. Thanks for visiting!

Subscribe to our YouTube Channel: http://bit.ly/YouTubeAOHare

Angela O’Hare

Favorite Las Vegas Realtor

Home Realty Center

Lic. #180246

702-370-5112

[email protected]

www.neighborhoodsinlasvegas.com