Top 5 Expensive Luxury Neighborhoods in Henderson, NV

August 8, 2022

Best Water Parks Near Las Vegas

August 11, 2022What’s Going on with the Las Vegas Real Estate Market? August 2022 Market Update

Las Vegas Real Estate Market Update – August 2022

Las Vegas Real Estate Market Update for August 2022. Welcome to the August 2022 issue of our monthly market update for Southern Nevada. In this issue we will be going over July 2022 numbers.

Market Trends – August 2022

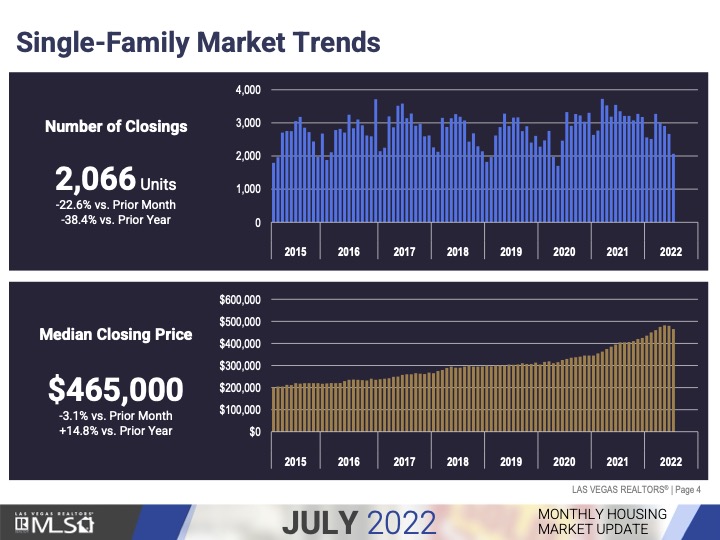

There were 2,066 single-family houses that sold in July, down 22.6% from June and down 38.4% from July 2021.

The median sales price of previously owned single-family homes, went from $480,000 in June to $465,000 in July, a $15,000 decrease in median price; which is down 3.1% from June, but still up 14.8% from the prior year.

In July 2021, the median price of previously owned single-family homes was at $405,000.

In July 2020, the median price of previously owned single-family homes was at $330,000.

The median sales price of condos and townhomes went from $282,000 in June to $271,800 July, a $10,200 decrease in median price; which is down 2.9% from June, but still up 21.2% from the prior year.

In July 2021, the median price of condos and townhomes was at $224,250.

In July 2020, the median price of condos and townhomes was at $196,000.

Luxury Market – August 2022

There were 97 homes that sold in July for $1 million and over, compared to June’s 147 homes, a 50 home decrease.

The median sales price in the Luxury Market for July decreased to $1,300,000 and in May that number was $1,399,999. Almost $100,000 decrease in the median sales price.

Market Trends – August 2022

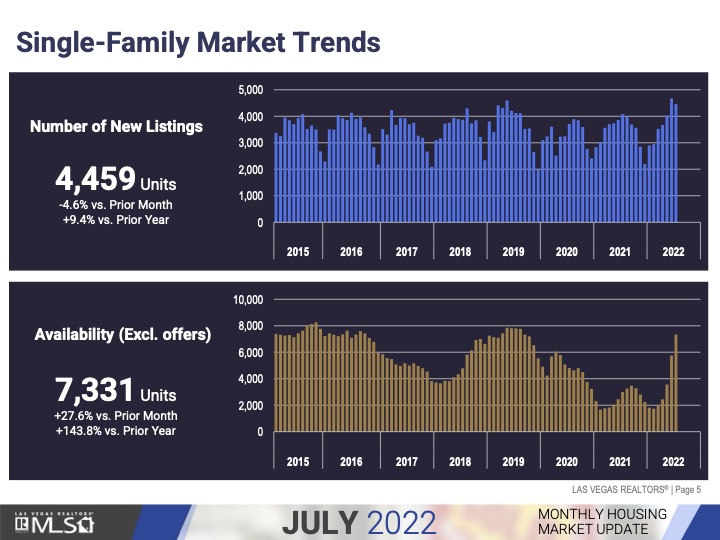

So, for July we had a total of 4,459 new listings, which was up 4.6% from June and up 9.4% from the prior year.

In July 2021, there were 4,077 new listings on the market. Which seems to be in line with the number of new listings for July 2022.

There were also a total number of 7,331 single-family houses listed without offers at the end of July, (In June that number was 5,746) which is up 27.6% from June and up 143.8% from the prior year.

Market Trends – August 2022

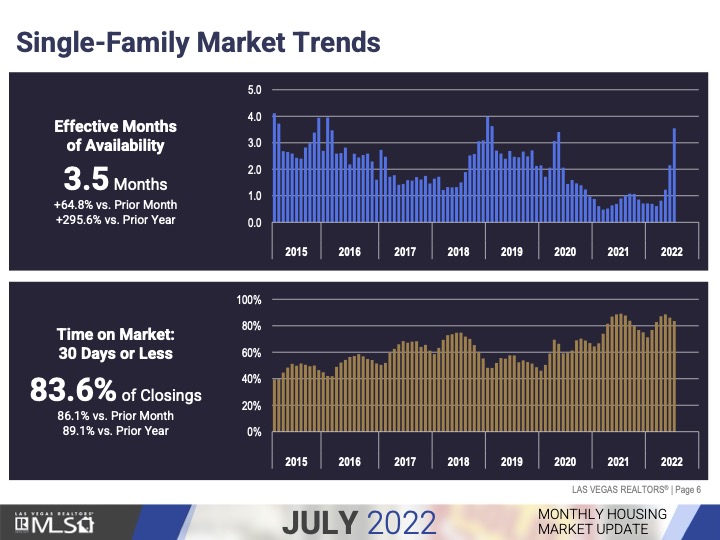

Which brings us to the housing supply in Southern Nevada, we increased to 3.5 months of inventory, in June that number was at 2.2, which is up 64.8% from June and up 295.6% from the prior year.

Last July 2021, the housing supply was at .9 months.

83.6% of the closings for the month July was on the market 30 days or less, in June this number was at 86.1% and in July 2021, 89.1% of the homes were on the market 30 days or less.

INTEREST RATES

The average rate on a 30-year mortgage was 4.99% as of Thursday, down from 5.3% the week before, mortgage buyer Freddie Mac reported. This marked the first time since April that the rates dropped below 5%, but barely.

Freddie Mac Chief Economist Sam Khater said in a news release this week that rates are likely to “remain variable” because of uncertainty surrounding inflation and other factors.

NEW BUILDER INCENTIVES

Toll Brothers

For a limited time, Toll Brothers is offering a 3.99% 30-year fixed interest rate on a conforming loan or a 4.25% on a jumbo loan for quick move-in homes eligible to close by January 31, 2023. This exclusive offer includes a free 165-day rate lock.

They are also offering a 6% broker co-op on select quick move-in homes, that must close by 10/30/22.

Save up to $50,000 on a new home – Your monthly payment will be lower when you take advantage of finance savings from $15,000 up to $50,000+ versus buying a reduce priced home at current market rates.

Basically, you get up to $50,000 towards closing costs, interest rate buy downs, extended rate locks, and they can even use the money to pay mortgage insurance if they put less than 20% down.

If you go to their website, it goes over all the ways you can save. Link is provided in my blog post.

For a limited time, Pulte is offering 4.25% interest rate for the first 7 years on select quick move-in homes, when you use their in-house lender. Must put 20% down.

Let us know in the comments or call/text or email us if you want to learn more about all the quick move-in homes from these builders that are available across the valley.

Century Communities

Lock in an incredible 3.875% interest rate on a 30-year fixed rate FHA or VA loan when financing with their affiliated lender, Inspire Home Loans. Only 3.5% down payment is required! Or 4.5% interest rate on a 30-year fixed rate for a Conventional Loan.

They are calling this the Purple Tag Sale.

You must sign a contract and apply for a loan on or before 8/31/22 and close on or before 9/30/22. Receipt of extended rate lock is contingent upon buyer closing a loan with their affiliated lender, Inspire Home Loans.

Lennar Homes

I spoke with my Lennar rep and she said for a limited time, Lennar is offering 3.99% interest rate on a 30-year fixed loan on their quick move-in condos/townhomes that closes in August or September when you use their in-house lender.

Then they are offering 4.5% interest rate on a 30-year fixed loan on their quick move-in homes that closes in August or September when you use their in-house lender.

Lennar can also help with closing cost, the rep said she’s been seeing them pay all of the closing costs. They are trying to keep the prices, but offer incentives to buy down the rates or closing costs incentives.

SELLER ADVICE

- Do not expect to get over list price

- Do not expect to get multiple offers

- Do not expect to sell your home in a week

- Now more than ever, your home needs to be PERFECT! Super clean and free of clutter.

ROB & ANG BETS

MEDIAN SALES PRICE

Rob said $8,000 decrease

Ang said $5,000 decrease

It actually decreased by $15,000

Rob came the closest, so he won!

WITHOUT OFFERS

Rob said 7,200

Ang said 8,000

Actual # 7,331

Rob is the clear WINNER!

MONTHS OF SUPPLY

Rob said 3.5 months

Ang said 4 months

Actual # 3.5 months

Rob is the clear WINNER!

What did you think of our Market Update for August 2022?

Homes for sale in Summerlin

August 2022 Las Vegas Realtor Report

Also, if you are thinking about buying or selling in the Las Vegas Valley, CLICK HERE or you can call me at 702-370-5112.

Subscribe to our YouTube Channel: http://bit.ly/YouTubeAOHare

Angela O’Hare

Favorite Las Vegas Realtor

Home Realty Center

Lic. #180246

702-370-5112

[email protected]

www.neighborhoodsinlasvegas.com

Related Posts:

- August 2023 Las Vegas Real Estate Market Update

- Las Vegas Home Prices Near Record High - August 2024

- Las Vegas Real Estate Market Update - July 2023

- The HIGHS & LOWS of the Las Vegas Real Estate Market…

- Las Vegas Real Estate Heatwave: How Long Will It Last?

- Las Vegas Real Estate Projects to Watch for in 2026