New Years Eve 2025 in Las Vegas

December 7, 2024

Discover Mesa Ridge in Summerlin by Toll Brothers

December 14, 2024Las Vegas Market Update – December 2024

Las Vegas Housing Market Update – December 2024

Join us LIVE as Rob and I dive into the Las Vegas December 2024 housing market and unpack what happened in November 2024. Sales and new listings took a dip, but the median price surprisingly went up. What does this tell us about the market’s direction? Where are we heading as 2024 comes to a close?

Remember, November’s numbers reflect deals made in October before the election. With the election behind us, we predict December’s numbers will look quite different, potentially signaling an increase in sales. We’ll also share our insights into what the housing market might hold for 2025!

Plus, we’ll break down all the builder incentives available this month and discuss why now is still a great time to consider buying a new construction home.

Oh, and don’t miss the friendly rivalry—find out who won last month’s bets between Rob and me! Mark your calendars and tune in for an in-depth market analysis, predictions for the future, and everything you need to know about navigating the Las Vegas housing market this December 2024!

MARKET TRENDS

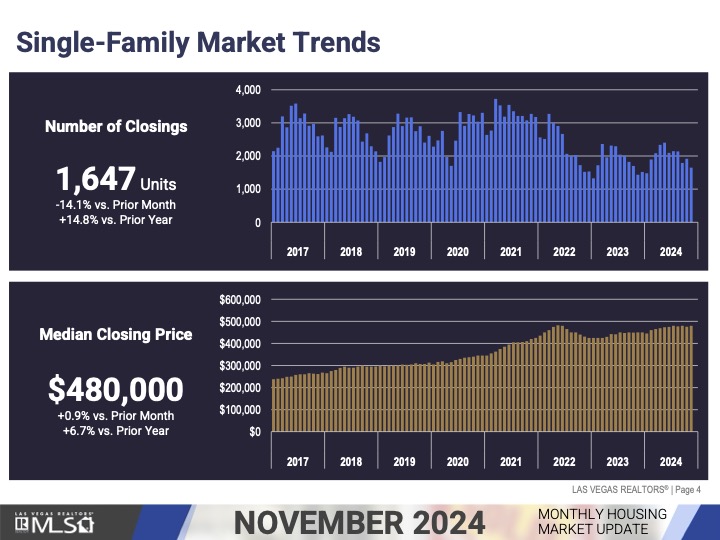

There were 1,647 single-family houses that sold in November, down 14.1% from October, but up 14.8% from November 2023.

The median sales price of previously owned single-family homes, went from $475,531 to $480,000 in November, a $4,469 median price increase; which is up .9% from last month and up 6.7% from November 2023.

So, from November 2023 to November 2024, we had a $30,000 median price increase in single-family homes.

In November 2024, the median price of previously owned single-family homes was at $480,000.

In November 2023, the median price of previously owned single-family homes was at $450,000.

In November 2022, the median price of previously owned single-family homes was at $430,990.

In November 2021, the median price of previously owned single-family homes was at $420,000.

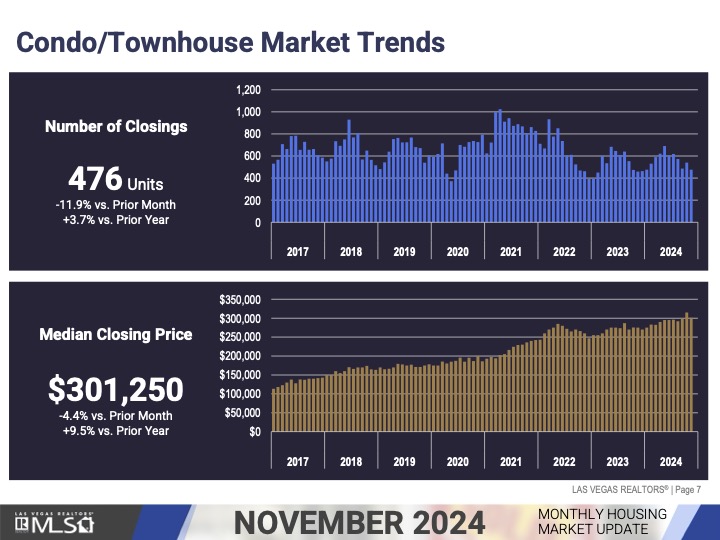

The median sales price of condos and townhomes for November went from $315,000 to $301,250, at $13,750 median price decrease; which is down 4.4% from October, but up 9.5% from the prior year.

So, from November 2023 to November 2024, we also had a $26,250 median price increase in condos/townhomes.

In November 2024, the median price of condos and townhomes was at $301,250.

In November 2023, the median price of condos and townhomes was at $275,000.

In November 2022, the median price of condos and townhomes was at $260,000.

In November 2021, the median price of condos and townhomes was at $24-,000.

LUXURY MARKET

There were 109 homes that sold in November for $1 million and over, compared to October 112 homes, 3 home decrease.

The median sales price in the Luxury Market for October decreased to $1,368,000 and in October that number was $1,450,000. A $82,000 decrease in the median sales price.

MARKET TRENDS

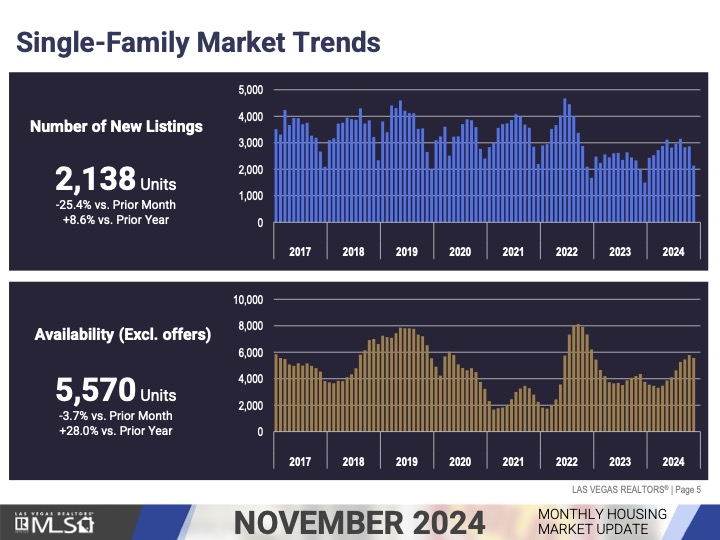

So, for November we had a total of 2,138 new listings, which is down 25.4% from October, but up 8.6% from the prior year.

There were also a total number of 5,570 single-family houses listed without offers in November, which is down 3.7% from the previous month, but up 28% from the prior year. (Slide #2

November 2023 there were 4,382 single-family homes listed without offers, which is 1,188 less homes on the market in 2023 compared to this year.

November 2022 there were 7,342 single-family homes listed without offers, which is 1,772 more homes on the market in 2022 compared to this year.

MARKET TRENDS

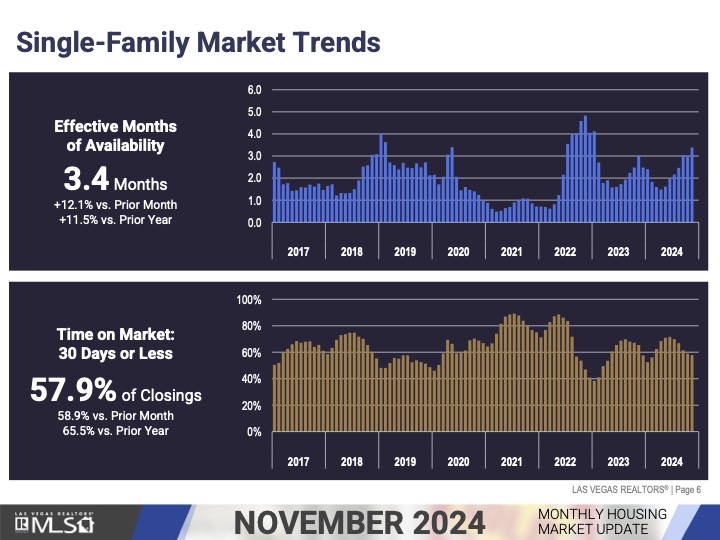

Which brings us to the housing supply in Southern Nevada, last month we are at 3.4 months of inventory on the market, which is up 12.1% from October and up 11.5% from the prior year.

November 2023 we were at 3 months of inventory on the market.

November 2022 we were at 4.8 months of inventory on the market.

57.9% of the closings for the month November was on the market 30 days or less, in October this number was at 58.9% and in November 2023, 65.5% of the homes were on the market 30 days or less.

NEW BUILDER INCENTIVES – December 2024

As we approach the end of the year, it’s shaping up to be an excellent time to invest in a move-in-ready, new construction home. While I mention this every year, the final quarter is typically when builders offer their best incentives and more favorable interest rates. Plus, they want to make their year-end numbers. With the forecasted decrease in rates by year-end, it’s likely that builders may reduce the generous incentives we’ve seen in previous years.

Many new construction communities are nearing completion, and this is where some of the best deals can be found. To make the most of these opportunities, you’ll want an experienced real estate agent who knows how to negotiate effectively with builders on your behalf.

Century Communities is having their GRAND FINALE Event. Unbelievable savings on select homes when financing with Century Communities affiliate lender, Inspire Home Loans. Get 4.875% interest rate when using an FHA and VH loans, plus get $20,000 toward closing costs.

Rates are available only on the purchase of select Century Communities homes that sign a contract on or before 12/11/2024 and that close on or before 12/31/2024.

Century Communities is the only builder that you have to buy your move-in ready home on-line. I highly suggest that you have an agent first to help you navigate through the process and to ensure you get the best deal possible.

Pulte is offering limited time special financing on a 2 to 1 buydown, get at 2.99% interest rate the first year, 3.99% interest rate the second year, and 4.99% interest rate from years 3-30 on Pulte’s select quick move-in ready homes when you finance through Pulte Mortgage and go under contract from now and close by 2/28/25.

Richmond American is having their READY.SET.SAVE Event. They offering special 30-year, fixed-rate financing options —while funds last! Must be under contract by 12/15 to take advantage of these rates. You also have to use their preferred lender, Home American Mortgage Corporation to take advantage of these special interest rates.

Fixed Rate Close by 12/31/24

4.50% 30-year FHA fixed rate w/ 3.5% down

4.50% 30-year VA fixed rate w/ $0 down

4.99% 30-year Conventional fixed rate w/ 10% down

Taylor Morrison is having their The Right Time? Right Now event. They are offering a limited time fixed interest rate at 5.49% for a 30-year fixed mortgage on select quick move-in homes in the Las Vegas area.

Valid on new home contracts entered from now until 12/31/24 on all eligible Las Vegas area Quick Move-in Homes that close on or before 1/31/24 (“Promotion Period”).

For a limited time on select quick move-in homes, Toll Brothers Mortgage Company is offering reduced interest rates for the first two years of your 30-year fixed loan and then a locked interest rate starting with year three for the remaining loan term.

The first year get 3.87% interest rate, second year 4.875% interest rate and from years 3-30 get 5.875% interest rate. This offer is only available on homes that close by January 31, 2025, so take advantage of this great rate now.

ROB & ANG BETS – December 2024

MEDIAN SALES PRICE

Rob said $4,500 decrease*

Ang said $3,500 decrease

Actual # increased by $4,469

NO ONE won this!

WITHOUT OFFERS

Rob said 5,901

Ang said 5,900

Actual # 5,570

ANG won this one!

MONTHS OF SUPPLY

Rob said 3.4 months

Ang said 3.2 months

Actual # 3.4 months

ROB won this one!

Las Vegas Realtors Report

If you’re considering buying or selling a home in the Las Vegas Valley, please don’t hesitate to reach out to me. I’ll get back to you personally and promptly. Thanks for visiting!

Subscribe to our YouTube Channel: http://bit.ly/YouTubeAOHare

Angela O’Hare

Favorite Las Vegas Realtor

Home Realty Center

Lic. #180246

702-370-5112

[email protected]

www.neighborhoodsinlasvegas.com