Christmas Events in Las Vegas on the Strip

November 25, 2022

Las Vegas Home Prices Lose All of 2022’s GAINS

January 11, 2023Las Vegas Real Estate Market Update for December 2022

Las Vegas Real Estate Market Update – December 2022

Welcome to the December 2022 issue of our monthly market update for Southern Nevada. In this issue we will be going over November 2022 numbers.

Market Trends

There were 1,521 single-family houses that sold in November, down 11.8% from October and down 53.5% from November 2021.

The median sales price of previously owned single-family homes, went from $440,000 to $430,900, down 2% from October, but still 2.6% from the prior year.

The median sales price of a previously owned single-family house has now dropped by just over $51,000 from a record-high $482,000 in May.

In January 2022, the median price of previously owned single-family homes was at $435,000.

In November 2021, the median price of previously owned single-family homes was at $420,000.

In November 2020, the median price of previously owned single-family homes was at $345,000.

The median sales price of condos and townhomes went from $266,000 in October to $260,000 in November, a $1,000 decrease in median price; which is down 2.3% from October, but up 8.3% from the prior year.

In January 2022, the median price of condos and townhomes was at $243,000.

In November 2021, the median price of condos and townhomes was at $240,000.

In November 2020, the median price of condos and townhomes was at $199,700.

Luxury Market

There were 63 homes that sold in November for $1 million and over, compared to October’s 97 homes, 34 home decrease.

The median sales price in the Luxury Market for November decreased to $1,350,000 and in October that number was $1,530,000. Almost $180,00 decrease in the median sales price.

Market Trends

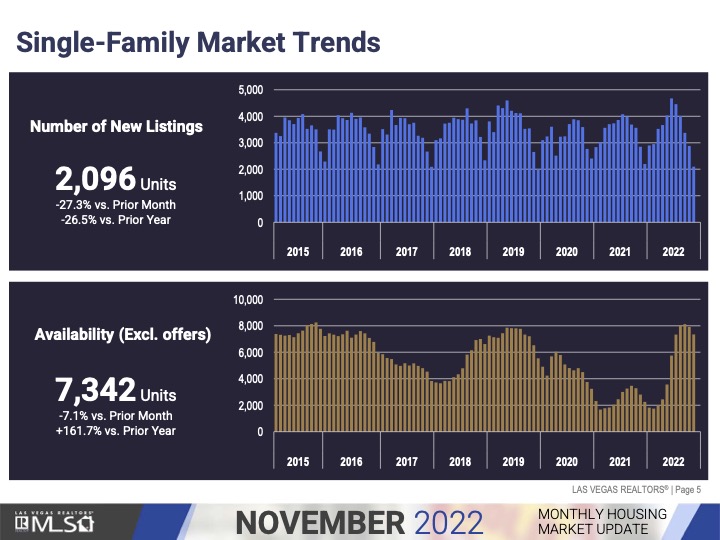

So, for November we had a total of 2,096 new listings, which is down 27.3% from October and down 26.5% from the prior year.

In November 2021, there were 2,851 new listings on the market. Which is a lot more listings last year than this year.

There were also a total number of 7,342 single-family houses listed without offers at the end of November, (In October that number was 7,906) which is down 7.1% from October, but up 161.7% from the prior year.

Market Trends

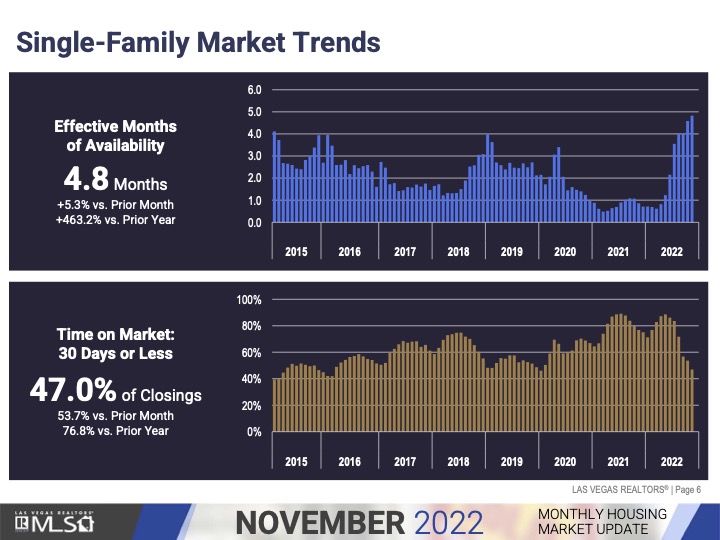

Which brings us to the housing supply in Southern Nevada, there are 4.8 months of inventory on the market, which is up 5.3% from October and up 463.2% from the prior year.

47% of the closings for the month November was on the market 30 days or less, in October this number was at 53.7% and in November 2021 76.8% of the homes were on the market 30 days or less.

INTEREST RATES

The average rate on a 30-year home loan was 6.49 percent last week, up from 3.11 percent a year earlier, mortgage buyer Freddie Mac reported.

NEW BUILDER INCENTIVES

Builders’ land buying activity had also “basically decreased to zero as they wait and see where things end up going into the end of the year.

Toll Brothers

New Year New Home – Limited-Time Incentives now through January 15,2023 on select homes and communities.

Get up to 3% Credit at Closing on In-Progress Homes and 50% off of up to $100,000 in Options on To-Be-Built Homes.

Taylor Morrison

There are many ways to take advantage of special end-of-year savings when you buy an eligible Las Vegas area home now through December 31 with Taylor Morrison.

For a limited time, secure a 5.99% 30-year fixed rate plus enjoy lower payments for 3 years so you can buy confidently today. Lock in first year interest at 2.99%, second year 3.99%, third year 4.99% and 4-30 years 5.99% fixed rate. When you work with their affiliated lender, Taylor Morrison Home Funding.

Plus, save up to $40,000 on the advertised price of select eligible homes.

Pulte

Limited time year-end SAVINGS! Pulte is offering 4.99% interest rate on a 30-year fixed loan, on select quick move-in homes, must close by 12/30/22 and you have to use Pulte Mortgage and put 20% down.

Richmond American Homes

For homes that close by 1/31/23, enjoy 4.875% (5.916% APR) financing available for a 30-year FHA & VA fixed rate.

For homes that close by 3/31/23, enjoy a:

5.500% (6.545% APR) 30-year FHA fixed rate

5.500% (5.810% APR) 30-year VA fixed rate

5.875% (6.482% APR) 30-year Conventional fixed rate

OR 5.500% (6.329% APR) Conventional 7/6 ARM financing

You have to use their in-house lender.

Tri Pointe Homes

Tri Pointe Homes is having the THE GREAT RATE REWIND EVENT. Take advantage of this limited-time 30 year fixed 2-1 buydown. Celebrate a First Year Rate of 3.875% (5.969% APR) on select Quick Move-In homes and when you use Tri Pointe lender.

The Tri Pointe Homes Design Consultants have carefully selected all the finishes on these under construction and move-in ready homes so your beautiful dream home awaits.

KB Homes

KB Homes is providing a special low rate to help make your dream of owning a reality. This limited-time opportunity can make all the difference for your purchase. Finance your new KB home through KBHS Home Loans and lock in a rate of 4.990% (5.333% APR) for up to 270 days.

Woodside Homes

Lock in a 4.99% interest rate today with Woodside Homes on a 30-year fixed interest rate. Not only is your rate guaranteed, but we’ll also give you the option to refinance for free if rates drop within the next two years.

This limited time 4.99% 30-year fixed interest rate is valid on new home contract entered between now and 12/31/22 for select Quick Move-In Homes that close on or before 1/20/23 using Preferred Lender and a 30-year fixed rate conventional mortgage with a minimum of 10% non-refundable down payment and a minimum of 740 credit score.

ROB & ANG BETS

MEDIAN SALES PRICE

Rob said $11,000 decrease

Ang said $10,000 decrease

Actual #9,010

Ang won this one!

WITHOUT OFFERS

Rob said 8,500

Ang said 8,100

Actual # 7,342

Ang won this one!

MONTHS OF SUPPLY

Rob said 4.8 months

Ang said 4.6 months

Actual # 4.8 months

Rob is the clear WINNER.

Las Vegas Realtors Report December 2022: http://bit.ly/3FxYZug

Also, if you are thinking about buying or selling in the Las Vegas Valley, CLICK HERE or you can call me at 702-370-5112.

Subscribe to our YouTube Channel: http://bit.ly/YouTubeAOHare

Angela O’Hare

Favorite Las Vegas Realtor

Home Realty Center

Lic. #180246

702-370-5112

[email protected]

www.neighborhoodsinlasvegas.com